Empowering investors with insights, analysis and expert recommendations to navigate financial markets with confidence.

Editors pick

Recent Articles

Sunrise Energy Metals (ASX: SRL) - Positioned at the Strategic Heart of Western Critical Minerals Supply Chains

Sunrise Energy Metals (ASX: SR...

Dec 11, 2025 | Proactive Equities Team

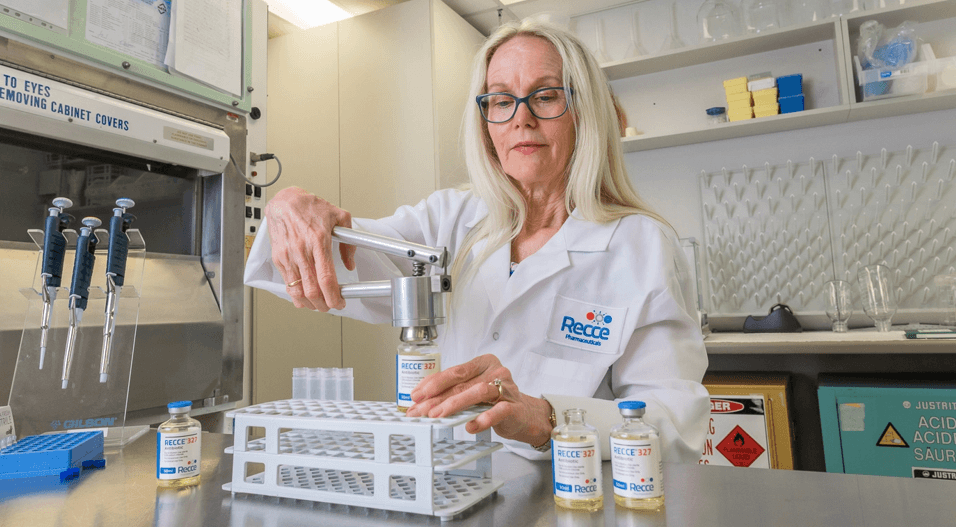

How Much Higher Can Recce Pharmaceuticals' (ASX: RCE) Share Price Go After the Recent Breakout?

Recce has recently attracted a...

Dec 8, 2025 | Proactive Equities Team

Get access to Proactive Equities’ latest high conviction stock picks and trade signals

Our Standard Membership will give you access to

Our Dividend Portfolio

Our Growth Portfolio

High Conviction Buys Now

Sector Reports

Fortnightly Investor webinars

Weekly Macro Insights

Our Premium Membership will give you access to:

Short-term Trading Signals

Our Dividend Portfolio

How Much Higher Can CETTIRE's (ASX: CTT) Share Price Go After the Recent Breakout?

Cettire (ASX: CTT) share price...

Dec 8, 2025 | Proactive Equities Team

Our Growth Portfolio

High Conviction Buys Now

Sector Reports

Fortnightly Investor webinars

Weekly Macro Insights

NRW Holdings is emerging from FY25 with strengthened financial performance, record order book visibility, and renewed momentum across its mining, civil, and MET (Maintenance & Engineering) segments. With EBITDA growing, margins stabilising, and a robust pipeline supported by long-life Tier-1 resources projects, NWH has entered FY26 well-positioned for continued earnings expansion. The company’s durability across cycles, combined with strong cash generation and rising recurring revenue streams, reinforces the investment case for long-term holders.

We see HY2025 as the first genuinely credible step in EVO’s multi-year turnaround. Not a cosmetic clean-up. Not a one-off bounce. A real shift. Occupancy is climbing, labour stability is improving, centre-level margins are widening, and cashflow finally has the shape of something we can underwrite. Management has been making tough decisions — cutting deadweight centres, fixing staffing inconsistencies, and rebuilding trust in local communities — and the P&L now reflects it.

We continue to view Accent Group (AX1) as one of the few genuinely scaled, defensible retail platforms in Australia and New Zealand. In a sector where earnings volatility is the norm and brand power often trumps execution, AX1 stands out because it has quietly built a multi-brand ecosystem that gives it pricing control, data-driven consumer reach, and operational leverage that smaller retailers simply cannot replicate.

YanCoal Australia (YAL) remains one of the most cash-generative coal producers on the ASX, offering investors a high-yield, low-debt exposure to thermal and metallurgical coal markets.

McMillan Shakespeare (ASX: MMS) delivered strong FY2025 growth, driven by record customer retention, expanding EV leasing, and disciplined balance sheet management. Positioned for long-term demand in sustainable mobility, MMS offers recurring revenue, robust cash flow, and significant dividends.

Fleetwood Limited (ASX: FWD) is positioning itself as a major player in Australia’s modular construction and accommodation industry. Through its three divisions — Building Solutions, RV Solutions, and Community Solutions — the company has built a resilient, diversified business model capable of navigating cyclical shifts in housing, tourism, and resources.

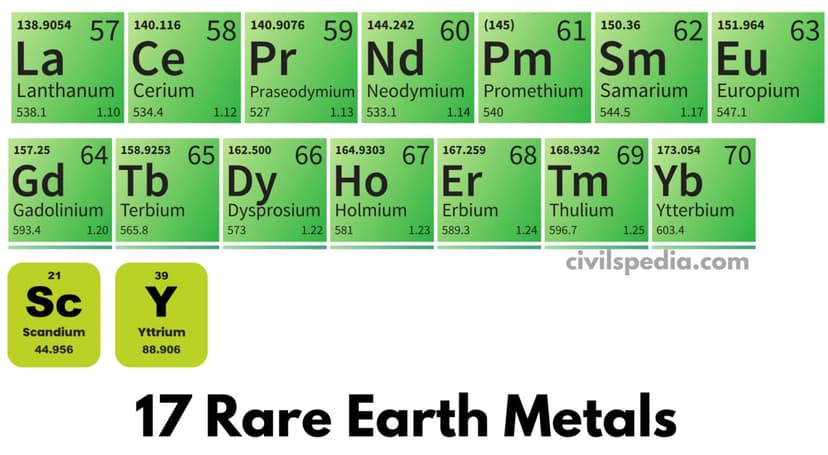

Sunrise Energy Metals (ASX: SRL) is advancing one of the Western world’s most strategically significant battery-materials developments: the Sunrise Nickel-Cobalt-Scandium Project in NSW, a globally large, long-life, ESG-aligned source of critical minerals essential for EVs, aerospace alloys, defence technologies and high-performance fuel cells. Backed by strong balance sheet discipline, rising government engagement, escalating Western supply-security policies, and material advancement across strategic partnerships during 2025, Sunrise enters 2026 with a profile we view as deeply undervalued relative to its strategic optionality.

Recce has recently attracted attention because it’s advancing drug candidates against serious infections, a space with significant potential if late-stage trials succeed. That kind of promise is why some market watchers see upside in RCE’s shares. On the flip side, the company remains unprofitable, with no consistent earnings or predictable cash flow, so it’s still a speculative biotech rather than a stable performer.

Cettire (ASX: CTT) share price recently had a breakout. But it is in a bit of limbo; enough promise remains that a rebound could be on the cards, but enough uncertainty that it’s far from a safe bet. On one hand, the company is forecast to post healthy earnings-per-share growth over the next few years and has a pretty low price-to-sales ratio compared with peers, suggesting some latent value. On the other hand, consensus analyst targets hover modestly, some even see a drop, and many believe any upside beyond roughly one Australian dollar a share depends on improvements that aren’t guaranteed.

The small-cap medical-tech company, Control Bionics, has just taken steps that could catapult it far beyond its current size. Its core product, a wearable sensor that translates even the faintest muscle or nerve signals into computer commands, is already approved and helps people with severe physical disabilities communicate and interact. Recently, the company announced that it had integrated a significant tech giant’s brain-computer interface protocol into its devices.

Investigator Silver (ASX: IVR), formerly known as Investigator Resources, is moving through one of the most strategically important phases in its history. The company is advancing the Paris Silver Project, Australia’s highest-grade undeveloped primary silver deposit, while simultaneously delivering exploration wins across its 100%-owned Peterlumbo tenement and progressing copper-gold targets at Uno Morgans.

Zip closed FY25 with what we consider a genuine inflection point: a record A$13.1bn in TTV and A$170.3m of group cash EBTDA — a level of profitability that would’ve sounded fanciful 18 months ago. The US arm is now the locomotive of the group, while ANZ has quietly rebuilt its margin spine. Momentum spilled straight into 1Q FY26, with TTV of A$3.9bn and cash EBTDA of A$62.8m, prompting management to hike US TTV guidance and expand the buyback to A$100m.

We view Invictus Energy as a rare example of an explorer with a clear pathway to development in one of Africa’s last underexplored rift systems. The Mukuyu gas-condensate discovery in Zimbabwe’s Cabora Bassa Basin anchors the portfolio, while high-impact follow-up at Musuma-1 and a strategic financing partnership with Al Mansour Holdings (AMH) materially de-risk the next stage of value creation.

BrainChip is a pioneer in ultra-low-power, neuromorphic AI processing, anchored by its Akida spiking neural network architecture. With US$13.5 million cash as of June 2025, the company is funding aggressive commercialisation efforts, including next-gen Akida 2.0, Pico devices, and defence / edge-AI partnerships. While financial performance is still pre-profit, recent commercial wins, deep IP protection, and product roadmap momentum provide compelling optional upside. Key risks include cash burn, technology adoption, and scaling edge-AI deployments.

European Lithium is positioning itself as a future supplier of battery-grade lithium to Europe, with the Wolfsberg Project in Austria advancing through permitting, engineering, and early-stage financing activities.

Race Oncology (ASX: RAC) is executing on a bold clinical strategy centered on RC220 (bisantrene reformulation), targeting both cardioprotection and enhanced anticancer activity in combination with doxorubicin. The company has dosed its first patient in a Phase 1 solid tumor trial, expanded into South Korea, and strengthened its clinical leadership team, all while maintaining disciplined cash management (A$13.67m at June 2025) to fund operations into 2026. Though early-stage, RAC presents a compelling mid- to long-term optionality scenario for investors with conviction in cardio-oncology and specialty chemotherapy.

Global data point to a softening but still mixed growth backdrop, with US manufacturing in mild contraction contrasted against resilient services activity. Labour indicators such as ADP employment and continuing jobless claims show cooling private hiring and more challenging re‑employment conditions, reinforcing expectations of earlier and deeper Federal Reserve rate cuts. Core US PCE inflation is running at a steady, moderate pace, allowing the Fed to stay on hold while waiting for clearer evidence that inflation is durably converging to the target.

When you spend enough time around the ASX, you start to notice a certain rhythm in how strong charts behave. Some stocks creep for weeks, building energy in tight ranges, and then, almost without announcement, they begin flashing early signs of strength. In this review, we focus on three ASX-listed companies whose price action suggests further upside.

Lithium prices are rising again, which tends to lift investor interest in ASX-listed producers. Thanks to growing demand for batteries (EVs, energy storage) and tightening supply, analysts suggest the recent price upswing, roughly 20–25% month-on-month, may mark a turning point. In that context, some ASX companies with solid operations and cash flow stand out as offering relatively better risk-adjusted opportunities. Still, it’s not a guaranteed path: lithium remains a volatile commodity, and gains now reflect renewed optimism rather than long-term certainty.

When you track the ASX day after day, you eventually spot those moments when a stock stops drifting and suddenly kicks into gear. A clear breakout, the kind that pushes past weeks of hesitation, often tells you buyers are finally taking control. In this article, we’re looking at three Australian companies whose share prices have recently surged through key resistance levels. These aren’t just quick spikes or one-day wonders. Each chart shows a pattern of tightening ranges, rising volume, and a decisive move that suggests momentum may continue.

The global macroeconomic backdrop shifted notably in the week ending 28 November 2025, fuelling a renewed "risk-on" sentiment that propelled a decisive recovery in Australian equities. In the United States, softening labour market indicators—specifically an acceleration in weekly ADP job losses—combined with a cooler-than-expected Core PPI reading and dovish commentary from Federal Reserve officials, led to a sharp repricing of interest rate expectations, with markets now pricing in an ~85% probability of a December cut. This pivot abroad overshadowed sticky domestic inflation data, allowing interest-rate-sensitive growth sectors to lead the S&P/ASX 200 higher, even as uncertainty persists around the Reserve Bank of Australia’s policy path.

Australia is increasingly important in the global REE supply chain as countries seek alternatives to China’s dominance. Key companies on the Australian Securities Exchange (ASX) are standing out thanks to substantial deposits, processing capability, and strategic supply-chain links. Leading the pack is Lynas Rare Earths Ltd (ASX: LYC), which mines the high-grade Mount Weld deposit in WA, has processing facilities outside China and is among the few globally capable of turning ore into refined products. Australia has the raw materials; the companies that control both the mines and the processing stand to benefit most.

In the current markets, even major players listed on the S&P/ASX 200 aren’t immune to caution flags on the charts. In this article, we'll examine three ASX-listed stocks whose price action suggests further downside may be ahead. We’ll look beyond the fundamentals and focus on technical signals: breakdowns below key moving averages, chart patterns like lower highs or descending triangles, and weakening momentum indicators.

The global macroeconomic backdrop shifted notably in the week ending 23 November 2025, contributing to a significant risk-off sentiment that heavily impacted Australian equities. In the United States, a mixed labour market report showing rising unemployment alongside stronger-than-expected job additions, combined with firm Services PMI data and Federal Reserve minutes signalling a delay in rate cuts, led to a repricing of interest rate expectations.

Global markets rallied on hopes of a resolution to the U.S. government shutdown, though the Fed's caution dampened expectations for a December rate cut. In Australia, robust employment data and a resilient labour market have reduced near-term expectations of an RBA rate cut. The ASX posted its weakest week in four months amid sector rotation and global tech selloffs.