Telstra Group (ASX: TLS) - A Defensive Cash Compounder with Embedded Digital Optionality

We view Telstra as a highly resilient, structurally advantaged cash-generating business within the Australian equity market, offering strong earnings quality and downside protection despite limited headline growth. Its focus on network leadership, disciplined capital management and monetisation of digital and infrastructure assets supports stable free cash flow and reliable capital returns, particularly in a softer macro environment. We believe the market continues to undervalue Telstra’s leverage to long-term data demand, the durability of its mobile economics, and the embedded optionality in InfraCo and enterprise digital services.

Transurban Group (ASX: TCL)- Infrastructure Quality at Scale: Cash Flow Compounding Through Cycles

Transurban is a high-quality global infrastructure franchise with long-duration, inflation-protected cash flows, strong pricing power and irreplaceable assets. The market remains overly focused on macro headwinds, overlooking the durability of its concessions, recovering mobility and improving cash-flow conversion. As operational risk declines and cost pressures fade, Transurban is well positioned to deliver asymmetric upside through FY26–FY28 via compounding distributions and operating leverage.

Fortescue (ASX: FMG)- A Tier One Iron Ore Cash Machine with Deep-Cycle Energy Optionality

In our assessment, FMG is neither a simple iron ore beta nor a speculative green-energy experiment. It is a structurally low-cost, high-free-cash-flow industrial platform that deliberately uses surplus mining rents to accumulate long-dated strategic options in energy and decarbonisation. FY25 and the September 2025 quarterly update reinforce our view that Fortescue remains one of the most financially resilient miners globally, even as it operates in a more volatile commodity and macro environment.

National Australia Bank (ASX: NAB)- Business Banking Leverage, Deposit Power, and a Re-rating Setup into FY26–FY27

We believe National Australia Bank (ASX: NAB) is entering a structurally more attractive phase of its earnings cycle, one that the market is only partially pricing. FY25 confirms that NAB has completed a difficult multi-year transition from remediation-heavy execution towards balance-sheet-led growth, operational leverage, and disciplined capital deployment. In our view, National Australia Bank is no longer just a “solid major bank.” It is increasingly a business-banking-centric compounder, with improving margin resilience, strengthening deposit mix, stabilising asset quality, and credible technology-driven productivity optionality.

CSL Limited (ASX: CSL) – Structural Quality Re-Asserted

We believe CSL Limited (ASX: CSL) remains one of the highest-quality global healthcare franchises listed on the ASX, with FY25 marking a clear re-acceleration in earnings quality, cash flow conversion, and strategic clarity. While the share price has periodically struggled to reflect this underlying strength, we view CSL as misunderstood rather than mis-executing.

Collins Foods (ASX: CKF) - Why We Think CKF Is Entering Its Strongest Earnings Cycle Since Pre-COVID

We believe Collins Foods (ASX: CKF) is entering a multi-year earnings recovery cycle anchored by margin repair in Australia, operational rejuvenation in Europe, clear line-of-sight to double-digit EBITDA growth, and an improving balance sheet that gives management options rather than constraints. The HY26 results demonstrate that CKF is moving decisively out of the inflation shock period that suppressed margins and elevated operating costs between 2022–2024. With commodity and utilities inflation easing, labour efficiencies improving, and price/mix still resilient, we see structural tailwinds forming beneath the company’s operating base.

Commonwealth Bank of Australia (ASX: CBA) - Why We See Structural Strength in Australia’s Premium Bank

Commonwealth Bank of Australia (ASX: CBA) remains the undisputed heavyweight of the Australian financial system, dominant in retail banking, advantaged by scale, and well-positioned to monetise the next phase of household re-leveraging as rates peak and credit growth stabilises. Our view is simple: CBA’s franchise resilience is undervalued. While the macro backdrop remains mixed and competition in mortgages remains intense, the bank continues to deliver sector-leading returns, defend margin leadership, and maintain one of the strongest balance sheets globally.

Rio Tinto (ASX/LSE: RIO) - A Global Materials Engine Re Accelerating into a New Cycle

Rio Tinto appears to be entering a strategically attractive new phase, evolving beyond its historic reliance on Pilbara iron ore into a diversified, multi-commodity growth platform. With expanding exposure to copper, lithium, high-grade iron ore and aluminium, alongside a stabilising cost base and strong balance sheet, the company increasingly looks positioned for asymmetric upside through 2026–2028 rather than a mature, iron ore–centric producer.

Larvotto Resources (ASX: LRV): Building Australia’s Next Antimony–Gold Producer

Larvotto Resources Limited (ASX: LRV) is an Australian emerging mining company transitioning from explorer to near-term producer. Its flagship asset, the Hillgrove Antimony–Gold Project in New South Wales, positions the company as a potential supplier of two strategically important metals: gold—a monetary safe-haven—and antimony, a critical mineral used in batteries, semiconductors, and defense alloys.

Talga Group (ASX: TLG) — Powering Europe’s Low-Carbon Battery Future

Talga Group is positioning itself as a cornerstone of Europe’s sustainable battery supply chain through its integrated mine-to-anode model in Sweden. With its Luleå anode refinery approaching production readiness and government-backed funding in place, Talga is moving from concept to commercial reality. The company’s low-carbon Talnode® products target the fast-growing EV and energy-storage markets, offering a differentiated, locally sourced alternative to Asian graphite imports.

Liontown Resources (ASX: LTR): Powering the EV Revolution from Kathleen Valley

Liontown Resources (ASX: LTR) is a next-generation lithium developer advancing toward production at its flagship Kathleen Valley Project in Western Australia. With Tier-1 offtake partners and strong financial backing, Liontown is poised to become a key player in the global EV and battery supply chain.

Arafura Rare Earths (ASX: ARU) — Building Australia’s Rare Earth Future

Arafura Rare Earths (ARU) is progressing its flagship Nolans NdPr Project in the Northern Territory — a fully integrated mine-to-separation operation targeting strategic electrification supply chains. With formal government backing, advanced engineering progress, and off-take partnerships in motion, ARU is positioning itself as a critical rare-earth supplier to global EV and wind OEMs.

Race Oncology (ASX: RAC) - A High-Risk, High-Reward Oncology Play

Race Oncology (ASX: RAC) is executing on a bold clinical strategy centered on RC220 (bisantrene reformulation), targeting both cardioprotection and enhanced anticancer activity in combination with doxorubicin. The company has dosed its first patient in a Phase 1 solid tumor trial, expanded into South Korea, and strengthened its clinical leadership team, all while maintaining disciplined cash management (A$13.67m at June 2025) to fund operations into 2026. Though early-stage, RAC presents a compelling mid- to long-term optionality scenario for investors with conviction in cardio-oncology and specialty chemotherapy.

European Lithium (ASX: EUR) — the Push toward European Lithium Independence

European Lithium is positioning itself as a future supplier of battery-grade lithium to Europe, with the Wolfsberg Project in Austria advancing through permitting, engineering, and early-stage financing activities.

BrainChip Holdings (ASX: BRN): High-Optionality Growth Play

BrainChip is a pioneer in ultra-low-power, neuromorphic AI processing, anchored by its Akida spiking neural network architecture. With US$13.5 million cash as of June 2025, the company is funding aggressive commercialisation efforts, including next-gen Akida 2.0, Pico devices, and defence / edge-AI partnerships. While financial performance is still pre-profit, recent commercial wins, deep IP protection, and product roadmap momentum provide compelling optional upside. Key risks include cash burn, technology adoption, and scaling edge-AI deployments.

Zip Co Limited (ASX: ZIP) — From BNPL Pioneer to Global Fintech Contender

Zip closed FY25 with what we consider a genuine inflection point: a record A$13.1bn in TTV and A$170.3m of group cash EBTDA — a level of profitability that would’ve sounded fanciful 18 months ago. The US arm is now the locomotive of the group, while ANZ has quietly rebuilt its margin spine. Momentum spilled straight into 1Q FY26, with TTV of A$3.9bn and cash EBTDA of A$62.8m, prompting management to hike US TTV guidance and expand the buyback to A$100m.

Investigator Silver (ASX: IVR)- Positions for Catalysts Amid Strengthening Silver Market

Investigator Silver (ASX: IVR), formerly known as Investigator Resources, is moving through one of the most strategically important phases in its history. The company is advancing the Paris Silver Project, Australia’s highest-grade undeveloped primary silver deposit, while simultaneously delivering exploration wins across its 100%-owned Peterlumbo tenement and progressing copper-gold targets at Uno Morgans.

Control Bionics (ASX: CBL) - This microcap's share price could explode higher from here!

The small-cap medical-tech company, Control Bionics, has just taken steps that could catapult it far beyond its current size. Its core product, a wearable sensor that translates even the faintest muscle or nerve signals into computer commands, is already approved and helps people with severe physical disabilities communicate and interact. Recently, the company announced that it had integrated a significant tech giant’s brain-computer interface protocol into its devices.

How Much Higher Can CETTIRE's (ASX: CTT) Share Price Go After the Recent Breakout?

Cettire (ASX: CTT) share price recently had a breakout. But it is in a bit of limbo; enough promise remains that a rebound could be on the cards, but enough uncertainty that it’s far from a safe bet. On one hand, the company is forecast to post healthy earnings-per-share growth over the next few years and has a pretty low price-to-sales ratio compared with peers, suggesting some latent value. On the other hand, consensus analyst targets hover modestly, some even see a drop, and many believe any upside beyond roughly one Australian dollar a share depends on improvements that aren’t guaranteed.

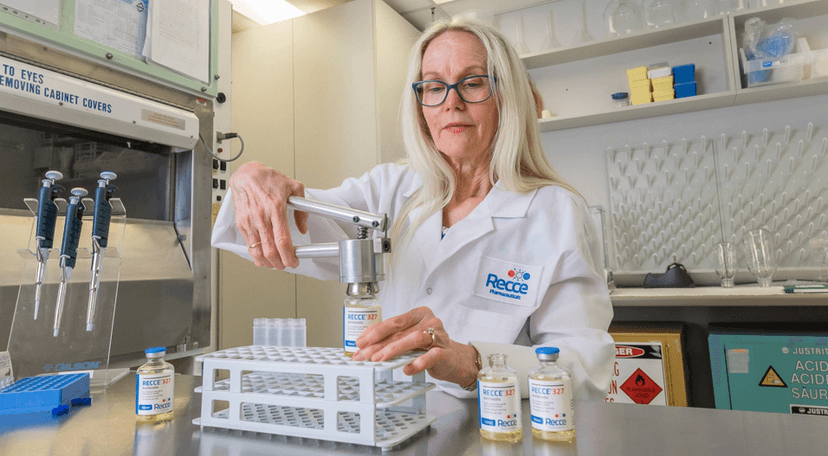

How Much Higher Can Recce Pharmaceuticals' (ASX: RCE) Share Price Go After the Recent Breakout?

Recce has recently attracted attention because it’s advancing drug candidates against serious infections, a space with significant potential if late-stage trials succeed. That kind of promise is why some market watchers see upside in RCE’s shares. On the flip side, the company remains unprofitable, with no consistent earnings or predictable cash flow, so it’s still a speculative biotech rather than a stable performer.

LaserBond (ASX: LBL)- Engineered for Investors Seeking Durable Industrial Growth Exposure

LaserBond (ASX: LBL) has entered a structurally stronger period after FY25 delivered clear evidence of operating leverage, improved manufacturing efficiencies, and accelerating adoption of its surface-engineered technologies across mining, energy, defence, and agricultural markets. With its patented LaserBond® cladding and composite coating systems now demonstrating superior lifecycle economics versus traditional wear-resistance methods, the company is positioned as a high-margin engineering solutions provider rather than a cyclical industrial.

Megaport Limited (ASX: MP1), Re-Establishing Structural Growth Leverage

Megaport has evolved from a cash-intensive growth story into a more disciplined, cash-generative digital infrastructure business, with FY25 marking a clear structural turning point as costs reset, churn stabilised and balance-sheet risk reduced. While the market still views the company through outdated perceptions, we see improved unit economics, renewed credibility and emerging operating leverage, positioning Megaport for growing free cash flow and ongoing relevance in an increasingly hybrid, multi-cloud world.

Xero Limited (ASX: XRO): From Accounting Software to Global Small Business Operating System

Xero is transitioning from a high-growth SaaS accounting platform into a global small business operating system with improving earnings quality and rising operating leverage. FY26 interim results show resilient revenue growth, margin expansion from cost discipline, and deeper monetisation across payments, payroll and financial services. We believe the market still applies an outdated growth-at-any-cost lens, underestimating Xero’s emerging cash generation and embedded optionality.

Sunrise Energy Metals (ASX: SRL) - Positioned at the Strategic Heart of Western Critical Minerals Supply Chains

Sunrise Energy Metals (ASX: SRL) is advancing one of the Western world’s most strategically significant battery-materials developments: the Sunrise Nickel-Cobalt-Scandium Project in NSW, a globally large, long-life, ESG-aligned source of critical minerals essential for EVs, aerospace alloys, defence technologies and high-performance fuel cells. Backed by strong balance sheet discipline, rising government engagement, escalating Western supply-security policies, and material advancement across strategic partnerships during 2025, Sunrise enters 2026 with a profile we view as deeply undervalued relative to its strategic optionality.

Why is SportsHero's (ASX: SHO) share price rising and how much higher can it go?

SportsHero (ASX: SHO) is an early-stage Australian sports gamification and media company focused on mobile-first prediction and gaming platforms across Southeast Asia, primarily Indonesia. It offers leveraged exposure to regional digital gaming growth but carries high execution, funding and profitability risk typical of small-cap platform build-outs.

Waratah Mineral (ASX: WTM) has made multiple higher lows. Is it building the base for another leg up?

Waratah Minerals, an Australian gold-copper explorer in NSW, has rebounded strongly from last year’s lows. A clear pattern of higher lows suggests growing accumulation, easing selling pressure and sustained market interest, positioning the stock to potentially break higher if a catalyst emerges.

Atomo Diagnostics (ASX: AT1) uptrend is your friend!

Atomo Diagnostics (ASX: AT1) is showing a steady uptrend after a long quiet phase. Rising prices from recent lows, backed by stronger volume, suggest buyers are gradually absorbing supply. This persistent move higher points to improving sentiment and a technically supportive trend for now.

Arafura Rare Earths's (ASX: ARU) share price is trading at a strong support level, is it a buying opportunity?

Arafura Rare Earths (ASX: ARU) is trading near a key support zone after recent volatility, where buyers have previously stepped in. Strength in rare earth prices adds sector momentum. While this mix may signal opportunity, confirmation depends on support holding and the company delivering meaningful project progress.

Appen (ASX: APX) - One of the few AI stocks on the ASX with a currently rising share price

Appen Limited (ASX: APX), founded in 1996 and listed since 2015, is an Australian AI data specialist providing dataset sourcing, annotation, and model evaluation. Operating the Global Services and New Markets segments, it serves major tech clients across multiple industries, leveraging a 1M+ global workforce that spans 180+ languages in 130 countries.

European Lithium's (ASX: EUR) share price has bounced off its support level nicely. How much higher can it go?

European Lithium (ASX: EUR) has rebounded from a well-established support level on its daily chart, a move that suggests buyers continue to defend this key zone. While the company’s Wolfsberg project underpins its long-term European battery supply narrative, the recent lift is largely technical, driven by market psychology and historical buying interest.

NRW Holdings (ASX: NWH)-Positioned for Growth in FY26 and Beyond

NRW Holdings is emerging from FY25 with strengthened financial performance, record order book visibility, and renewed momentum across its mining, civil, and MET (Maintenance & Engineering) segments. With EBITDA growing, margins stabilising, and a robust pipeline supported by long-life Tier-1 resources projects, NWH has entered FY26 well-positioned for continued earnings expansion. The company’s durability across cycles, combined with strong cash generation and rising recurring revenue streams, reinforces the investment case for long-term holders.

Invictus Energy (ASX: IVZ) – A Frontier Play with Optionality

We view Invictus Energy as a rare example of an explorer with a clear pathway to development in one of Africa’s last underexplored rift systems. The Mukuyu gas-condensate discovery in Zimbabwe’s Cabora Bassa Basin anchors the portfolio, while high-impact follow-up at Musuma-1 and a strategic financing partnership with Al Mansour Holdings (AMH) materially de-risk the next stage of value creation.

.webp&w=828&q=75)

How much higher can Korvest (ASX: KOV) share price go after the recent breakout?

Korvest Ltd (ASX: KOV) is a South Australian industrial manufacturer specialising in cable and pipe support systems and corrosion protection services, with earnings linked to infrastructure, resources, energy and industrial activity, as well as ongoing maintenance demand.

Atlantic Lithium’s (ASX: A11) uptrend is holding amid heavy market turbulence. How significant is this show of resilience?

Atlantic Lithium has managed to hold its uptrend despite broader market turbulence, a sign of underlying strength in a weak environment for resource stocks. Steady buying at key support levels suggests confidence has not collapsed, supported by progress at its Ewoyaa lithium project in Ghana. This combination of solid fundamentals and constructive chart behaviour highlights resilience in a volatile, sentiment-driven sector.