Small-Caps

BrainChip Holdings (ASX: BRN): High-Optionality Growth Play

BrainChip is a pioneer in ultra-low-power, neuromorphic AI processing, anchored by its Akida spiking neural network architecture. With US$13.5 million cash as of June 2025, the company is funding aggressive commercialisation efforts, including next-gen Akida 2.0, Pico devices, and defence / edge-AI partnerships. While financial performance is still pre-profit, recent commercial wins, deep IP protection, and product roadmap momentum provide compelling optional upside. Key risks include cash burn, technology adoption, and scaling edge-AI deployments.

Invictus Energy (ASX: IVZ) – A Frontier Play with Optionality

We view Invictus Energy as a rare example of an explorer with a clear pathway to development in one of Africa’s last underexplored rift systems. The Mukuyu gas-condensate discovery in Zimbabwe’s Cabora Bassa Basin anchors the portfolio, while high-impact follow-up at Musuma-1 and a strategic financing partnership with Al Mansour Holdings (AMH) materially de-risk the next stage of value creation.

Investigator Silver (ASX: IVR)- Positions for Catalysts Amid Strengthening Silver Market

Investigator Silver (ASX: IVR), formerly known as Investigator Resources, is moving through one of the most strategically important phases in its history. The company is advancing the Paris Silver Project, Australia’s highest-grade undeveloped primary silver deposit, while simultaneously delivering exploration wins across its 100%-owned Peterlumbo tenement and progressing copper-gold targets at Uno Morgans.

How Much Higher Can CETTIRE's (ASX: CTT) Share Price Go After the Recent Breakout?

Cettire (ASX: CTT) share price recently had a breakout. But it is in a bit of limbo; enough promise remains that a rebound could be on the cards, but enough uncertainty that it’s far from a safe bet. On one hand, the company is forecast to post healthy earnings-per-share growth over the next few years and has a pretty low price-to-sales ratio compared with peers, suggesting some latent value. On the other hand, consensus analyst targets hover modestly, some even see a drop, and many believe any upside beyond roughly one Australian dollar a share depends on improvements that aren’t guaranteed.

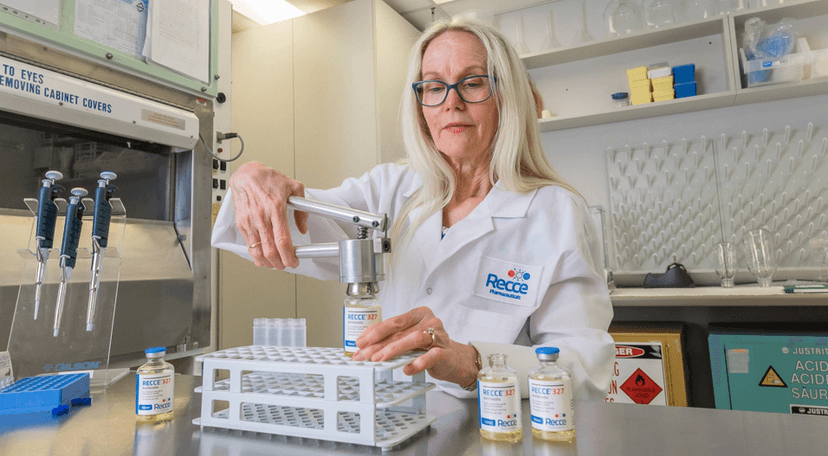

How Much Higher Can Recce Pharmaceuticals' (ASX: RCE) Share Price Go After the Recent Breakout?

Recce has recently attracted attention because it’s advancing drug candidates against serious infections, a space with significant potential if late-stage trials succeed. That kind of promise is why some market watchers see upside in RCE’s shares. On the flip side, the company remains unprofitable, with no consistent earnings or predictable cash flow, so it’s still a speculative biotech rather than a stable performer.

.webp&w=828&q=75)

How much higher can Korvest (ASX: KOV) share price go after the recent breakout?

Korvest Ltd (ASX: KOV) is a South Australian industrial manufacturer specialising in cable and pipe support systems and corrosion protection services, with earnings linked to infrastructure, resources, energy and industrial activity, as well as ongoing maintenance demand.

Waratah Mineral (ASX: WTM) has made multiple higher lows. Is it building the base for another leg up?

Waratah Minerals, an Australian gold-copper explorer in NSW, has rebounded strongly from last year’s lows. A clear pattern of higher lows suggests growing accumulation, easing selling pressure and sustained market interest, positioning the stock to potentially break higher if a catalyst emerges.

Appen (ASX: APX) - One of the few AI stocks on the ASX with a currently rising share price

Appen Limited (ASX: APX), founded in 1996 and listed since 2015, is an Australian AI data specialist providing dataset sourcing, annotation, and model evaluation. Operating the Global Services and New Markets segments, it serves major tech clients across multiple industries, leveraging a 1M+ global workforce that spans 180+ languages in 130 countries.

Atlantic Lithium’s (ASX: A11) uptrend is holding amid heavy market turbulence. How significant is this show of resilience?

Atlantic Lithium has managed to hold its uptrend despite broader market turbulence, a sign of underlying strength in a weak environment for resource stocks. Steady buying at key support levels suggests confidence has not collapsed, supported by progress at its Ewoyaa lithium project in Ghana. This combination of solid fundamentals and constructive chart behaviour highlights resilience in a volatile, sentiment-driven sector.